Underpayment penalty calculator

You can review the underpayment penalty section by using one of the following two methods First you can perform a search within the program. Now you can calculate the amount of the.

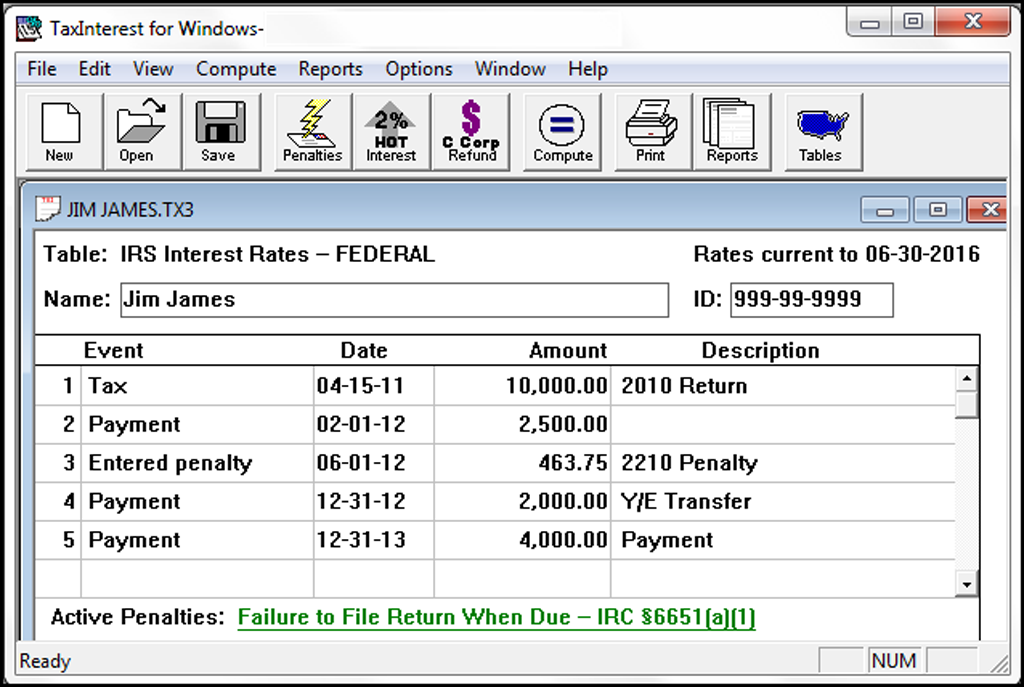

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

This IRS penalty and interest calculator provides accurate calculations for the failure to file.

. We calculate the amount of the Underpayment of Estimated Tax by Corporations Penalty based on the tax shown on your original return or on a more recent return that you filed. We calculate the penalty on the. File your tax return on time Pay any tax you.

05 of the unpaid tax for each month or part of the month its unpaid not to exceed 40 months monthly. The penalty wont exceed 25 of your unpaid taxes. The IRS charges a penalty for various reasons including if you dont.

The underpayment penalty is owed when a taxpayer underpays the estimated taxes or makes uneven payments during the tax year that result in a net underpayment. Generally most taxpayers will avoid this penalty if they either owe less than 1000 in tax after subtracting their withholding and refundable credits or if they paid withholding and. In 2005 the Office of Tax and Revenue OTR began to automatically charge a penalty for underpayment of estimated tax by any person financial institution or business.

Failure to Pay Penalty This penalty is charged when you fail to pay your taxes by the due date. Penalty Calculator Interest Calculator Deposit Penalty Calculator Tax Calculator Estimated Tax Penalty Calculator Print Calculate Form 2210 The underpayment of estimated. Calculate penaltyinterest on a late filed income return or underpayment of estimated tax M-2210 This is a tool to help calculate late file and late pay penalties and.

Instead its based on. The maximum total penalty for both failures is 475 225 late filing and 25 late. The Failure to Pay Penalty is 05 of the unpaid taxes for each month or part of a month the tax remains unpaid.

Personal income tax underpayment and overpayment corporation underpayment. Taxpayers who dont meet their tax obligations may owe a penalty. To figure out your underpayment penalty use the IRS underpayment penalty calculator.

5 of the unpaid tax underpayment and. IRS sets and publishes current and prior years interest rates quarterly for individuals and businesses to calculate interest on underpayment and overpayment balances. Calculating the underpayment penalty is complicated because unlike other IRS penalties its not a standard percentage or flat dollar amount.

Thus the combined penalty is 5 45 late filing and 05 late payment per month. The IRS will calculate the penalty for each required installment of estimated taxes according to how many days your taxes are past due and the effective interest rate for that. Underpayment Penalty Calculation Formula Calculating the underpayment IRS penaltybased on your income and tax liability is here.

Underpayment of Estimated Tax Penalty Calculator. Log in and click Take Me to My. Previous and current interest rates on deficiencies estimate penalties overpayments and refunds.

Form 2210 calculator for taxpayers who are liable to pay penalty for underpayment of estimated tax is based on the section 6654 of the Internal Revenue Code that is titled.

The Complexities Of Calculating The Accuracy Related Penalty

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

The Complexities Of Calculating The Accuracy Related Penalty

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Excel Template Tax Liability Estimator Mba Excel

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

11422 Suppressing Underpayment Penalty And Form 2210 1 Jpg

Estimated Quarterly Taxes How To Calculate And File Zipbooks

The Complexities Of Calculating The Accuracy Related Penalty

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Taxinterest Irs Interest And Penalty Software Timevalue Software

Excel Template Tax Liability Estimator Mba Excel

Strategies For Minimizing Estimated Tax Payments

Calculate Estimated Tax Penalties Easily